Variable Universal Life Insurance

可变万能人寿保险是一种永久人寿保险,它在投保人的一生中都有效. And, as with universal life insurance, 它提供灵活的保费和可调整的利益——这意味着投保人可以决定在设定的最低限额上投入多少. 推而广之,投保人还可以决定保单的票面金额.

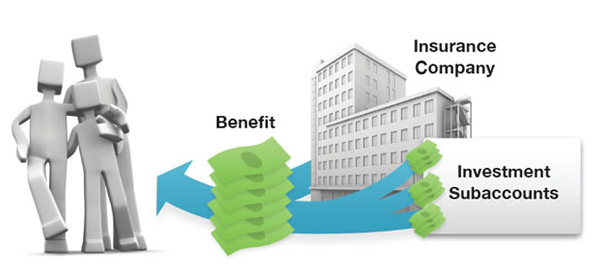

可变万能寿险和其他类型的永久寿险的区别在于 the policyholder directs how premiums are invested. 这为获得金融市场提供的潜在更高回报提供了途径. 这也意味着回报可能低于其他寿险产品.

一般而言,投保人可选择投资若干子帐户. 你可以选择固定利率,也可以选择各种股票、债券或货币市场. 保函以开证公司的偿付能力为依据.

Like other types of permanent life insurance, policyholders can even borrow a portion of their policy’s cash value under fairly favorable terms. 而保单贷款的利息支付会直接回到保单的现金价值中.*

When the policyholder dies, his or her beneficiaries receive the benefit from the policy. 根据保单结构的不同,福利可能需要纳税,也可能不需要纳税.

可变万能寿险有其独特的特点,可能会吸引一些保险购买者. However, 可变万能寿险政策也有选项,必须清楚地了解之前,个人承诺的政策.

*Generally, 如果满足某些条件,从政策中获得的贷款将免征当前所得税, such as the policy does not lapse or mature. 请记住,贷款和取款会减少保单的现金价值和死亡赔偿金. Loans also increase the possibility that the policy may lapse. If the policy lapses, matures, or is surrendered, the loan balance will be considered a distribution and will be taxable.

通过借款或部分退保来获取保单中的现金价值可能会降低保单的现金价值和收益. 使用现金价值也可能增加保单失效的几率,如果保单在您去世前终止,可能会导致纳税责任.

可变万能人寿保险的结构可以使累积的现金价值最终覆盖保费. However, 如果保单的股息减少或投资回报不佳,可能需要额外的现金支付.

有几个因素会影响人寿保险的费用和可得性, including age, health, and the type and amount of insurance purchased. 人寿保险单有费用,包括死亡和其他费用. If a policy is surrendered prematurely, 保单持有人还可能支付退保费并涉及所得税. 在实施涉及人寿保险的策略之前,你应该考虑确定你是否可以投保. 任何与保单相关的保证都取决于开证保险公司继续支付索赔的能力.

Withdrawals of earnings are fully taxable at ordinary income tax rates. If you are under age 59½ when you make the withdrawal, 你可能会被起诉并被处以10%的联邦所得税罚款. Also, withdrawals will reduce the benefits and value of the contract. Life insurance is not FDIC insured. 它不受任何联邦政府机构、银行或储蓄协会的担保. 视表现有可变寿险和可变万能寿险, the account value will fluctuate with changes in market conditions. At any time, 账户价值可能高于或低于投资于保单的原始金额.

投资前请考虑投资目标、风险、收费及费用. 可变人寿保险及可变万能人寿保险只以招股说明书发售. 有关费用和开支的信息可在招股说明书中找到,或向您的财务专业人员索取. Please read the prospectus carefully before you invest or send money.

内容的来源被认为是提供准确的信息. 本材料中的信息不作为税务或法律建议. 它不得用于避免任何联邦税收处罚的目的. 有关您个人情况的具体信息,请咨询法律或税务专业人士. 本材料由FMG Suite开发和制作,旨在提供有关您可能感兴趣的主题的信息. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. 所表达的意见和提供的材料仅供一般参考, 并且不应被视为购买或出售任何证券的招揽. Copyright FMG Suite.